What you need to know about rental insurance with Flecto

If you’re running a rental business - or considering the pros and cons of actually joining the rental economy -, one of the first questions that come to mind is how you can mitigate the risk associated with renting products. As we have covered in our previous blog, insurance for equipment rental plays a crucial role for a successful business run but the industry has lacked the necessary solutions to meet the different needs of rental companies.

In a nutshell, rental insurance is is an offer designed to protect the liability associated with renting. These programs generate legal policies that cover reparation and replacement whenever equipment is damaged or stolen. Though this sounds simple on a surface level, the reality is a bit more complicated than that.

There are numerous factors that come into play when creating a rental insurance solution and it is an arduous task to combine the perfect mix for a particular business. It’s important to question:

- What is the industry the company is operating in?

- What is the age and value of the equipment?

- How long does the rental period last?

- Are there any extra services that should be included in the insurance program?

- What are the underlying economics for both company and insurance provider?

- Who’s renting the equipment and what’s their previous track record?

A change in direction

An insurance program is primarily focused on mitigating financial trouble that would occur in case of damage, loss or legal action. However, it should also have a simple and flexible operating model, so business owners are not always worried about the possible consequences of renting equipment. In other words, it comes down to a hustle-free process that should bring tranquility and security to the company as a whole.

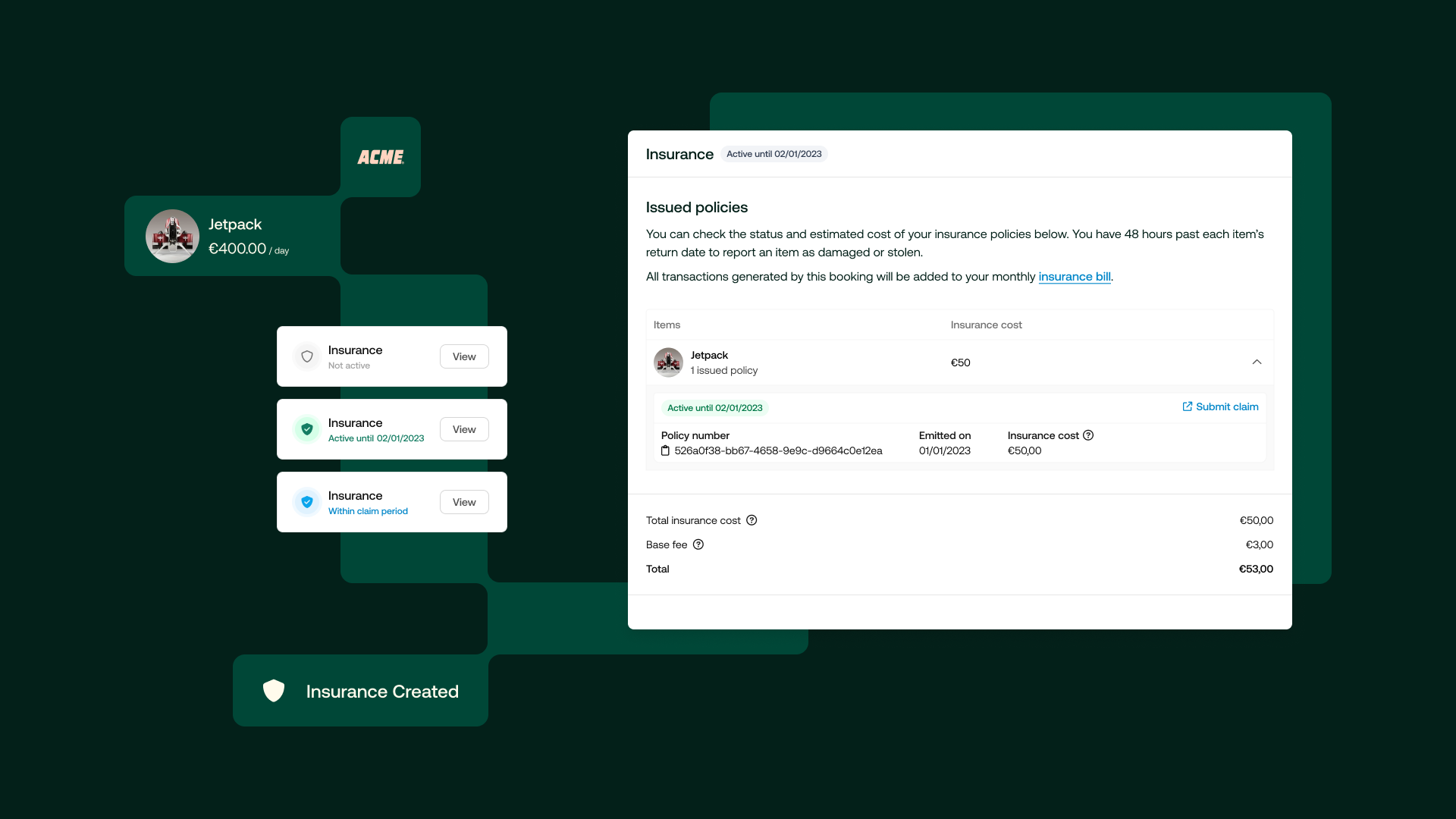

That’s why Flecto Insurance is the new and first-of-its-kind solution that protects equipment against damage and theft during the rental period. The program is designed to protect rental businesses by creating an 100% online process that automatically generates insurance policies for each item within a rental.

The pricing model is based on the average rental value of the client and item category, providing the necessary flexibility for different business types and volumes to join and enjoy the offer. Users can simply opt to pass these fees onto their customers, mitigating the need for exorbitant security deposits or complicated claims processes.

So how does the program work exactly?

All Flecto users have the option to subscribe to the insurance program at any given moment. After enabling the integration in the platform and accepting the terms and conditions, the solution will be active and ready to go within a few minutes.

After that, the journey is quite simple:

- You can choose to activate insurance for any new or existing booking. In each booking, you can access all insurance details, such as amount, duration and more. If you choose to activate it, insurance policies are automatically generated for every item in that booking.

- Rental managers have up to 8 days past the booking's end date to report an item as damaged or stolen, and they can report as many claims as they wish.

- The reimburse is calculated on the after-market value of the item, with a 20% max. depreciation and paid any time between a week and 10 days.

A new step in the rental revolution

Though Flecto Insurance is primarily designed to protect the integrity of items, the overall scope of the program goes beyond that. It stands on the very basis of a Circular Economy model, where products will primarily be fixed or refurbished in order to extend their lifecycle as much as possible. When an insurance program is in place to recondition equipment, its usage is prolonged and reduces the need to create more products or rely on non-reusable resources. In a nutshell, this solution is just one more step for companies to practice business more sustainably.

Flecto Insurance also stands on the basis of smart investments, with the goal of saving as much time and money from its users as possible. Alternative programs are usually expensive and can even place the responsibility of activating insurance onto the renters themselves. The Flecto way is meant to be easy, simple and customized. With no entering fee and a process modeled around booking volume, where the more bookings customers have the less the pay, the program helps companies be more financially sustainable.

More and more companies are looking for alternative models to buying and selling: they just need the right tools to enter the Circular Economy. And that’s where Flecto comes in. As the platform that makes businesses thrive in the circular economy, Flecto allows businesses to unlock and manage rental operations by all the essentials in one single platform.